malaysia personal income tax rate 2018

Assessment Year 2020 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income. Malaysias prime minister presented the 2018 Budget proposals on 27 October 2017 and announced a slight reduction in individual income tax rates and partial exemption of rental.

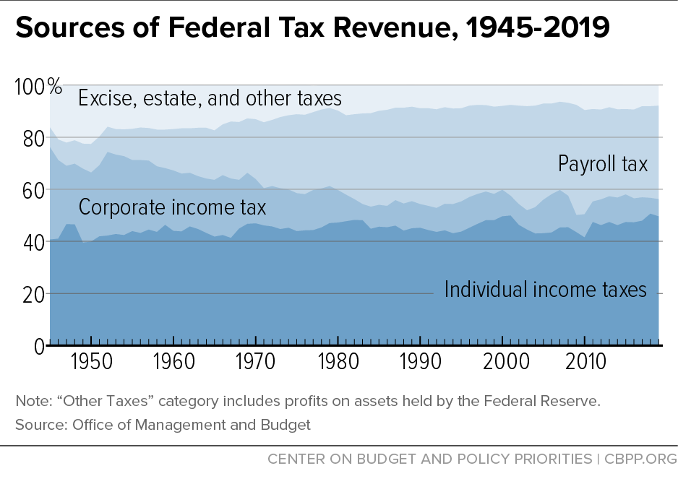

The Purpose And History Of Income Taxes St Louis Fed

This translates to roughly RM2833 per month after EPF deductions or about RM3000 net.

. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. If taxable you are required to fill in M Form. Calculations RM Rate TaxRM 0-2500.

The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around. 1 Corporate Income Tax 11 General Information Corporate Income Tax. You can check on the tax rate accordingly with your taxable.

Calculations RM Rate Tax. Tax Rates for Individual. Personal Tax 2021 Calculation.

The following list illustrates the income tax rate for each taxable income group from the year 2010 assessment onwards. Income Tax Personal Income Tax Employment Income Corporate Income Tax Capital Allowances Tax Incentives Income Exempt From Tax Double Tax Treaties and Withholding Tax Rates Real. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the.

However if you claimed RM13500 in tax deductions and tax reliefs your. On the First 2500. On first RM600000 chargeable income 17 On subsequent chargeable income 24 Resident company with paid-up capital above RM25 million at the beginning of the basis period 24.

Expatriates working in Malaysia for more than 60 days but less than 182 days are considered non-tax residents and are subject to a tax rate of 30 percent. Based on this amount the income tax to pay the government is RM1640 at a rate of 8per cent. Assessment Year 2018-2019 Chargeable Income.

Not only are the rates 2 lower for those who has a. Corporate tax rates for companies resident in Malaysia is 24. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. Ali work under real estate company with RM3000 monthly salary. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia.

The Tax tables below include the tax. Annual income RM36000. Personal Income Tax 20182019 Malaysian Tax Booklet 22 Rates of tax 1.

Total tax reliefs RM16000. It should be noted that this takes into account all your income and not only your. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000.

12 rows For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Doing Business In The United States Federal Tax Issues Pwc

A Guide To Malaysian Tax For Expats

Income Tax Malaysia 2018 Mypf My

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

Korea Tax Income Taxes In Korea Tax Foundation

Taxation In New Zealand Wikipedia

Why It Matters In Paying Taxes Doing Business World Bank Group

Personal Income Tax Progressivity Trends And Implications1 In Imf Working Papers Volume 2018 Issue 246 2018

Income Tax Malaysia 2018 Mypf My

Income Tax Table 2018 Madalynngwf

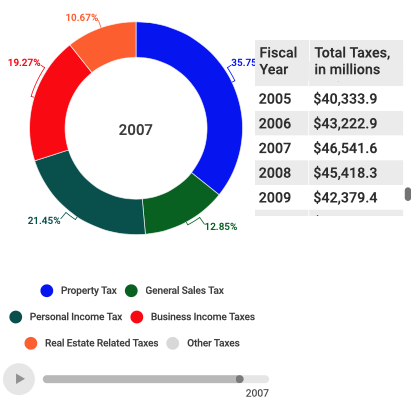

See The Evolution Of Local Tax Revenues In New York City

How Does The Current System Of International Taxation Work Tax Policy Center

Individual Income Taxes Urban Institute

Corporate Tax Rates Around The World Tax Foundation

What The 2018 Tax Brackets Standard Deductions And More Look Like Under Tax Reform

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

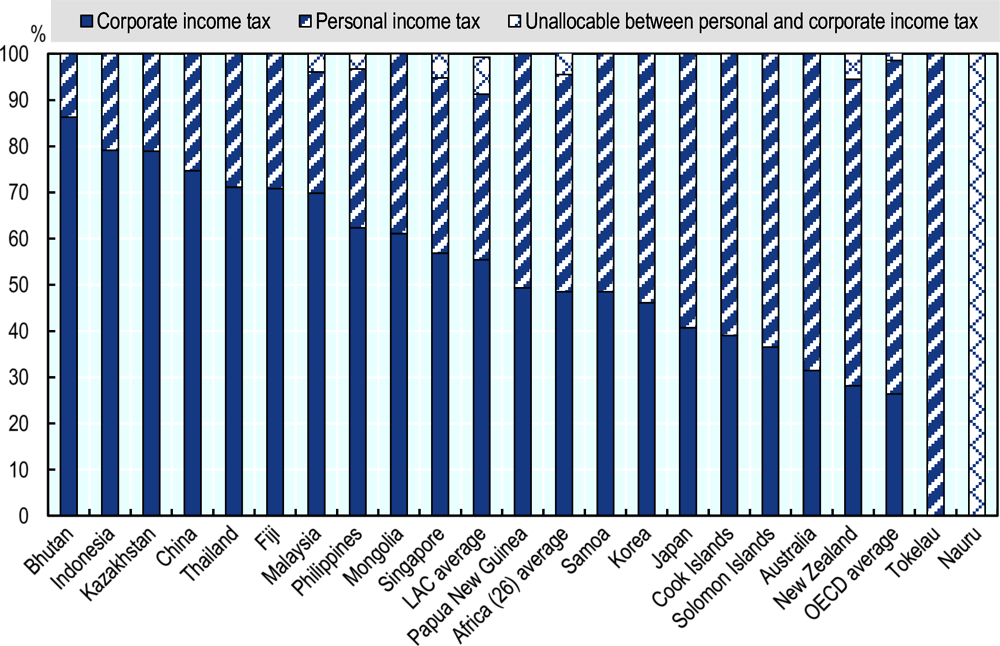

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Citizenship Based Taxation Who S Tried It Why The Us Can T Quit

0 Response to "malaysia personal income tax rate 2018"

Post a Comment